Martín Essenfeld, EGEP Consultores & Omar Medina, PetroNova, Colombia

The analysis and decision making applied to oil field assets evaluations is always strongly related to the risk associated with the uncertainties present in the process. A complete analysis generally depends on geological, economic factors and technological uncertainties that have different degrees of impact on the recovery process and can affect the decision process at different levels depending on the asset: reservoir characteristics, recovery mechanism, facilities and stage of field development.

With the “Indicador Integrado de Interés”, the different segments that have an impact on the quantification of the “value” of the Exploration and Production assets are integrated into a single analysis instrument, showing the advantages of coexisting knowledge, information and available data with automation and probabilistic calculation to reduce analysis time and making decisions to generate value.

Historically, serious efforts have been made to develop methodologies that allow hierarchical decision making from the exploratory point of view. Medina (1) and Yoris and Lugo (2). Since 1988, projects have been carried out to develop tools that allow weighing the “interest” or “value” of work packages to wells, acquisition of areas for exploitation or revitalization, sale of participations to generate funds or distribute risks in Producer Blocks, and other variants, all this to support the decision-making processes of different levels of importance.

That is, for decisions of different scales, the concept of “systematic hierarchy” has been used for very simple cases, such as choosing between a simple reconditioning or another within the sequence of jobs available to wells, to the other end in a enormous scale of choosing or ranking between one or another Exploratory Block, or deciding which sectors of Exploratory Blocks “to return” in the face of a situation of limited funds or the proximity of the expiration dates of the licenses, or another series of situations in the that it is necessary to “prioritize options to make decisions”.

Integration: Development Objective

The objective of this research and development effort is to use what has already been done in the past in the area of Indicator of Interest in different areas (exploration, development, and exploitation optimization) in order to move towards a new generation of Indicators Integrated Interest (hereafter using the acronym III). That is to say, the development and testing of a prototype of III is proposed and initiated.

It will include the most recent achievements in the areas of exploration, development, production and optimization of operations. In these four areas, the systematic management of information available from fields or areas close to the one being evaluated will be included in the application of the new tool.

Structure of III

It is proposed to structure the tool in four segments as follows:

- Segment 1 Exploration (EXPL)

- Segment 2 Production (PROD)

- Segment 3 Fields or Close Production (PROC)

- Segment 4 Integration (INTE)

Exploration Segment (EXPL)

References 1 and 2 (Medina, Yoris and Lugo, respectively) were reviewed in detail on specific tools for evaluation and ranking in the exploratory risk segment.

It was decided, in this opportunity, to use for this Segment 1 and in this development, the work of Medina. This decision was made due to its systematic structure, internal coherence, ease of understanding / use, and ease of integration into other segments. From the work of Medina (1) the structure for this Exploratory Segment was adopted.

Thus, the following four factors of the Exploratory Segment are proposed:

- Load (CG)

- Rock Container / Reservoir (RY)

- Trap (TR)

- Seal (SE)

Regarding Cargo (CG), Medina separates the load factor into two probabilistic elements: Probability of existence of bedrock and the Probability of Effective Migration, with the following components:

A) Probability of existence of Source Rock

- Thickness

- Areal extension

- Organic content level

- Thermal maturity

- Type of hydrocarbon generated

b) Probability of Effective Migration

- Migration ways

- Synchronization between migration and trap formation

Regarding to Rock Recipient / Reservoir (RY), Medina (1) considers it a single probabilistic segment (Probability of Existence of Effective Recipient Rock). However, this unique probabilistic segment must in turn reflect the following underlying elements

- Deposit thickness

- Areal extension

- Effective porosity (storage capacity)

- Permeability (flow capacity)

Regarding Trap (TR), the following elements are proposed:

- Definition of the trap

- Closing

- Retention capacity

- Post-entrapment retention

Finally, the Seal (SE), although it is a single probabilistic element, must consider the following factors:

- Vertical Stamp

- Thickness of the seal

- Stamp areal extension

- Integrity of the stamp

- Side seal (favorable juxtaposition)

In summary, the Exploration Segment (EXPL) in this development project of the III is conformed by the four factors indicated above: Loading, Rock-Reservoir, Trap and Seal.

Production Segment (PROD)

References 3 to 6 on specific tools for evaluation and ranking in the production segment (PROD) were reviewed in detail.

Factors of the Production Segment (Option 1)

- Characterization of the area’s deposits

- Size of the Resource Base

- Requirements for the development of reserves

- Future production profiles

- Investment and Operation Costs

- Technological Requirements

- Strength and / or policy of the Operators

- Consolidated Economic Analysis

Each of these factors consists of or consists of a group of “individual elements”.

Factors of the Production Segment (Option 2)

- Existing Fields

- Existing wells

Option 2 is a much simpler route in the process of assigning “value” within Indicator III.

Segment Fields or Close Production (PROC)

The inclusion of this Segment (PROC) aims to link the area under evaluation with the Indicator, the most relevant information that is known from neighboring areas, preferably producers.

This segment should include the following factors:

- Distance

- Quality of nearby fields

- Operational difficulties in nearby fields

Integration Segment (INTE)

This segment intends to use information from nearby fields to project value, positive or negative, towards the area under evaluation.

Once the architecture of three segments (Exploration, Production and Close Fields) has been proposed for the Indicator, an algorithm or system of algorithms is generated that should allow the following to the user:

- Assign weights to each segment of the same

- Relate the segments to each other

- Suggest to the user a weight scale by segment

- Indicate a score scale that assigns numerical values to the Indicator

It is proposed, in the first instance, for the Integrated Indicator of

Interest, an expression of the following type:

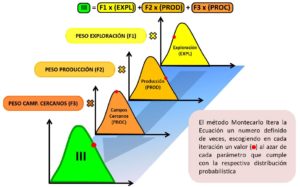

III = F1 (EXPL) + F2 (PROD) + F3 (PROC) … .. (Equation 1)

Where F1, F2 and F3 are the factors of weight expressed in fraction (chosen by the user according to the emphasis that you want to give to that segment (EXPL, PROD, PROC) in the evaluation.

At first:

F1 + F2 + F3 = 1.0 …………………………. … (Equation 2)

and therefore:

F1 = Fraction between 0.0 and 1.0

F2 = Fraction between 0.0 and 1.0

F3 = Fraction between 0.0 and 1.0

Probabilistic Approach for the EXPL, PROD and PROC Variables

Although an analysis of the sensitivity of the results of the Indicator (III) is made by varying the weights that represent the user’s interest or preference, this is completed in order to conclude that the III responds satisfactorily to changes, even if they were minor or useful , to those weights as a reflection of the user.

However, it has been observed that, in any event, the user’s interest or preference can and must be defined with certainty before using the Indicator. This is, even though a sensitivity analysis of the results is then made, in case of possible minor variations.

The same can not be said for the EXPL, PROD and PROC segments. Especially EXPL and PROD must be variable in time, as more seismic information is collected, exploratory wells are drilled, some wells originally exploratory are completed as producers, and in general “mature” the areas in terms of their analysis.

Schematic of the Probabilistic Estimation Process

With the probabilistic tool, six Scenarios of Exploratory and Producer Blocks were evaluated in this way, whose general characteristics are indicated below:

- Excellent Exploratory Block without production and with moderate information nearby

- Exploratory Block with production and moderate information nearby

- Exploratory Block without production or close information

- Completely producing block, with low additional exploratory potential and moderate additional information and moderate nearby information

- Block with intermediate values in all segments

Indicador Integrado de Interés applied to an asset in the Exploration stage

Conclusions

- A new tool called Integrated Interest Indicator (III) has been developed, evaluated and tested. It integrates an Exploratory Area or Segment (EXPL), an Area or Segment of Production (PROD) and Area or Segment of Information of Production of Nearby Areas (PROC).

- Additionally, a probabilistic procedure has been successfully tested to estimate values of EXPL, PROD and PROC, which allows to include for each of them the individual factors described in the work.

- With the probabilistic tool, six scenarios of Exploratory and Producer Blocks were evaluated in this way, whose general characteristics are indicated below:

- Excellent Exploratory Block without production and with moderate information nearby

- Exploratory Block with production and moderate information nearby

- Exploratory Block without production or close information

- Completely producing block, with low additional exploratory potential and moderate additional information and moderate nearby information

- Block with intermediate values in all segments

- Five series of weight variation of Base Cases were also evaluated in the probabilistic modality and for sensitivity analysis of the results, for a total of 30 example cases.

- The results of the probabilistic evaluation of these 30 cases confirm that: once the probabilistic distributions that accurately reflect the assumptions or conditions used in the Deterministic Analysis of the work are selected, the P50 probabilities of the Integrated Interest Indicator compare very favorably. with the deterministic results.

- The test and application of the Integrated Interest Indicator is now being carried out to a series of blocks of an extensive area with exploratory prospects and some production established inside and outside the areas under evaluation. The work in progress includes the unbundling of the Blocks in Partial Areas within each Block, in order to evaluate at the end their “absolute and relative value within each Block”.

References

- Medina Omar. “Análisis de Riesgo Exploratorio” Comunicación personal a Martín Essenfeld, Petronova Colombia – Bogotá (Co-lombia), Diciembre 2012

- Yoris Franklin, Lugo Jairo. “Características de la trampa estratigráfica de Carbonera Basal en el sureste de los Llanos Orientales”, Pacific Rubiales Energy – Bogotá (Colombia), Septiembre 2009

- Essenfeld Martín. “Indicador Cualitativo de Interés – Pruebas de campo en Venezuela”. Petróleo Internacional – Caracas (Venezuela), Enero 2006

- Essenfeld Martín, Vera Luis. “Desarrollo de Indicadores Cuali-tativos de Intereses para Localizaciones de Pozos de Desarrollo y Trabajos RA/RC”, VII Jornada Técnica de Petróleos, Sociedad Venezolana de Ingenieros de Petróleos – Puerto de la Cruz (Vene-zuela), Junio 1989

- Castillo Carla, Essenfeld Martín, Trebolle R. “Desarrollo y Prueba de una Metodología para incrementar la Producción en Áreas bajo Convenio Operativo”. Trabajo especial de Grado, Universidad Central de Venezuela – Enero 2002

- “Indicador de Interés – Metodología y Manual de Operación” EGEP Consultores S.A, Caracas (Venezuela) – Abril 2003

- Risk Analysis Simulation Using the Montecarlo Method” Palisade Corporation, Abril 2003.

Article reference:

Essenfeld, et al. (2014). Indicador Integrado de Interés: Nueva Herramienta Para Asignar Valor a Áreas de Exploración y Producción de Hidrocarburos. Petroleum, 30 (294), 30-32.